New opportunities for 5G base station RF industry chain development

2019-07-03

New opportunities for 5G base station RF industry chain development (antenna, PA, PCB, antenna oscillator, filter, connector)

Embracing 5G, base station antennas, PA, PCB, antenna oscillators, filters, connectors and other industries ushered in new opportunities.

The 5G base station introduces a large-scale array antenna.

Massive MIMO, which is a multi-input multiple-output (MIMO) technology, aims to greatly improve network capacity and signal quality through more antennas. In principle, the number of roads can be increased by analogous highways to increase traffic volume.

The 5G base station using Massive MIMO can not only increase the network capacity by multiplexing more wireless signal streams, but also greatly improve the network coverage capability through beamforming.

By adjusting the spatial distribution of the antenna gain, the beamforming technology concentrates the signal energy on the target terminal during transmission to compensate for the loss of spatial transmission after the signal is transmitted, and greatly improves the network coverage capability.

Compared with 4G base stations, the use of AAUs supporting large-scale array antenna technology is the main reason for the significant increase in the cost of 5G base stations.

The antenna size is frequency dependent, and the 5G antenna is mainly 64 channels.According to the principle of wireless communication, in order to ensure the highest efficiency of antenna transmission and reception conversion, the spacing of the antenna antenna must be greater than half the wavelength of the wireless signal, and the wavelength of the wireless signal is inversely proportional to the frequency of the wireless signal (λ = c / f, where c is the speed of light , f is the wireless signal frequency), that is, the higher the signal frequency, the smaller the signal wavelength.

In the future, the domestic 5G frequency band is mainly 3.5GHz and 2.6GHz. According to this frequency band, half wavelength is about 4.3cm/5.8cm.According to the current 5G test, the current 64-channel Massive MIMO technology is the mainstream test choice for various equipment vendors.

Although the number of channels is higher, the performance of the network is higher, but considering the size/weight of the antenna, the performance of the antenna, and the cost factor, operators are currently considering a low-cost Massive MIMO solution—16 channels.

We believe that if the 64-channel antenna cost does not fall within the range accepted by the operator in the early 5G, it is possible that the operator will give priority to the 16-channel solution when it meets the deployment and capacity.

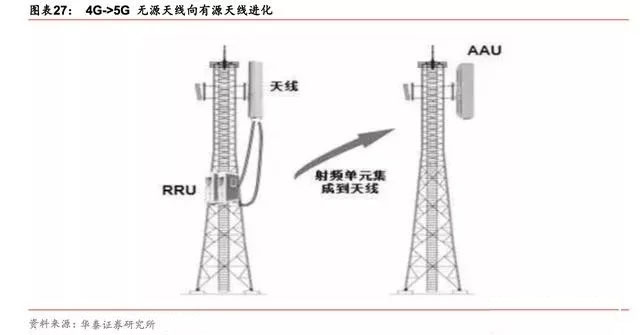

The 5G base station architecture has undergone major changes, and the antennaization trend is obvious.

The 4G macro base station is mainly divided into three parts: the antenna, the radio frequency unit RRU, and the baseband processing unit BBU deployed in the equipment room.

The 5G network tends to adopt the new wireless access network architecture of AAU+CU+DU, as shown in the following figure.

The antenna and radio unit RRU will be combined into a new unit AAU (Active Antenna Unit). In addition to the RRU radio function, the AAU will also include some physical layer processing functions.

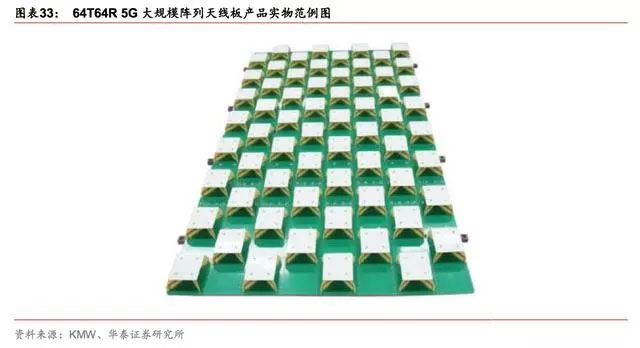

In the 5G era, the increase in the number of antenna channels and the antennaization of antennas place higher demands on antenna design, and miniaturization and weight reduction are the basis.In the 4G era, the antenna form is basically 4T4R (FDD) or 8T8R (TDD). According to the current test situation, the 5G era may be dominated by 64T64R large-scale array antennas.

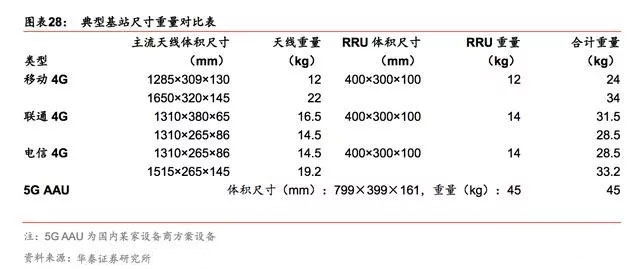

The number of channels increased by 7-15 times compared with the same period of last year, which means that the demand for RF devices increased by 7-15 times compared with the same period of the previous year. At the same time, the passive part of the antenna will be combined with the RRU as AAU, which both put forward the volume and weight of the antenna in the 5G era. High design requirements.In the 4G era, the weight of the passive antenna + RRU is about 24-34kg. The weight of the 5GAAU in the current test is about 45kg, and the weight is increased by 32%~88%. Therefore, under the trend of 5G antenna integration, miniaturization and lightweighting have become the basis of antenna design.

The demand for RF components driven by large-scale array antennas has increased dramatically.As mentioned above, we expect 5G commercial macro base stations to be dominated by 64-channel large-scale array antennas. The antenna unit mainly comprises three parts: a radome, a radiation unit and a calibration network integrated board.

From the current research and development status of 5G products, in order to achieve new technologies such as beam forming, we expect that the future 64-channel antenna array will accommodate 64 power amplifiers, 64 switches, 64 phase-locked loops, and 64 low-noise amplifiers. 64 filters and other devices.

We believe that the increase in demand for RF components will greatly increase the market space of the base station RF industry, and the high integration requirements will further promote the process of RF components such as filters and power amplifiers, and the products will be further miniaturized.

Large-scale array antenna drive 5G antenna value increase

The 5G large-scale antenna using Massive MIMO is not only an increase in number, but the form of the antenna will also be switched from passive to active, which can adaptively adjust the phase and power of each antenna oscillator, significantly improve the spatial resolution of the MIMO system and improve the spectral efficiency. , thereby increasing network capacity.

In addition, the dynamic combination of multi-antenna vibrators can also be applied to the beam forming technology, so that the smaller energy beams are concentrated in a small area, the signal intensity is concentrated in a specific direction and specific users, and the coverage is improved while improving the user experience.

Therefore, due to the adoption of Massive MIMO technology, the complexity of the 5G-scale array antenna has been greatly increased, and the price of the product has also risen sharply.

The price of large-scale array antennas is expected to increase significantly compared to 4G. Unlike the general perception of the market, the price of an antenna is not a simple linear relationship with the number of antenna elements.

Taking a 4G antenna as an example, the recently used 4-channel FDD electronically tuned antenna sells for about 1400 yuan per pair. The price of an 8-channel TDD electronically tuned antenna is about 2,000 yuan per pair. In the 5G era, according to the current experiment, 5G is used. Base station cost analysis, the antenna unit of the large-scale array antenna of the initial 64T64R specification (the upstream antenna manufacturer manufacturing part) is more expensive per sector, and we expect the purchase price of the commercial early antenna (passive antenna + filter in AAU) to reach Around 8,000 yuan, with the mass production, we expect the average price per sector in the future to drop to around 3,500 yuan, but the average antenna price in the 4G period still has a significant increase.

The market space of 5G antennas increased by 124%~324%. Assuming that the 5G construction period is 2020-2025, it is estimated that the macro base station antenna market in the peak period of construction (2020-2023) will reach 114.2-184.4 billion yuan per year; compared with the average domestic peak of 4G construction, the annual average is about 5 billion yuan (peak) In the macro base station antenna market where the 4G base station has a construction number of 1 million stations per year and the average price of a single antenna is 1700 yuan, the 5G market space has increased by 124% to 324%.

Antenna manufacturers that work intensively with base station equipment vendors may benefit fully.

In the 4G era, Hu awei ranked first among global antenna manufacturers.

According to the 2017 global base station antenna research report released by the world's leading third-party research institute ABI Research--"Tianqi Modernization, Leading the Evolution of Mobile Broadband Network", Huawei's antenna market share ranked second/third in 2012-2013, experienced China 4G The construction tide, starting from 2015, Huawei antenna has won the market share and technological innovation and the ability to transform its achievements for the second consecutive year, leading the development of the global antenna industry.

Among them, the proportion of major manufacturers in 2016 was 31.6% for Huawei, 21.0% for Catherine, 15.2% for Comm Scope, 7.3% for Amphenol, and 5.2% for RFS. Huawei's market share increased by 10.9pct compared with 2013.

The antenna market has changed its business model and its market share has concentrated on leading companies.

As the 5G base station antenna will be merged with the RRU to form a new unit AAU, the downstream customers of the antenna company will be transformed from the former operator to the equipment supplier.

Considering the small number of communication equipment vendors, the top four in the market (Huawei, Nokia, Ericsson, ZTE) almost monopolize the global carrier wireless communication market share (base station equipment market accounts for more than 90%), for antenna suppliers The downstream will be more concentrated.

Therefore, faucet antenna manufacturers who have deep cooperation with equipment vendors and have more technical reserves in large-scale array antennas are expected to gain more market share.

Antennas are advised to focus on upstream companies that work closely with equipment vendors.

With the advent of the 5G era, antennas and base station equipment achieve deeper binding.

Lightweight demand drives antenna oscillator upgrade

The antenna element is the core component of the antenna. As the main component of the antenna, the antenna oscillator is mainly responsible for amplifying the signal and controlling the radiation direction of the signal, and also making the electromagnetic signal received by the antenna stronger.

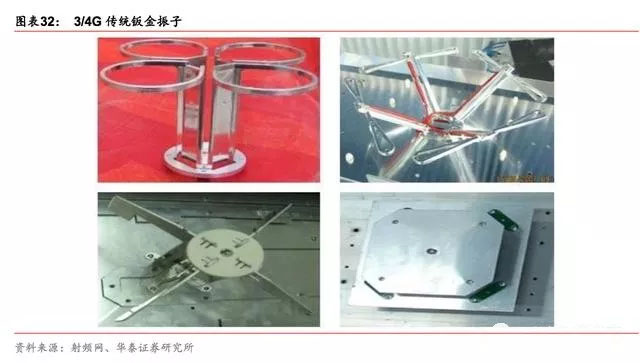

According to the shape of the antenna, the shape of the antenna oscillator also includes various shapes, such as a rod shape and a surface shape. According to the processing technology, there are mainly sheet metal, PCB, plastic, and the like. Traditional 4G antenna vibrators are mostly made of metal sheet metal.

Massive MIMO requires more antenna elements.

From the equipment manufacturer's test situation, the 64-channel antenna device is preferred in the hot-spot high-capacity area, and the 192-vibrator antenna device can improve the coverage capability by 1.7 dB compared with the 128-vibrator antenna. Currently, the equipment manufacturer tests the 64-channel antenna mostly using 96. A dual-polarized antenna oscillator, that is, 192 antenna elements.

Compared with the existing 4G network (generally 10-40 antenna vibrators depending on the number of antenna channels), the number of vibrators included in the 5G antenna will increase significantly.

Although it is easier to reduce the spacing between the antenna elements in the high frequency band, and realize the design of multiple antennas and the miniaturization of the products, the complexity is still greatly improved compared with the existing antenna products. The following figure shows a prototype of a 5G large-scale antenna array prototype.

Plastic antenna vibrators or become the preferred solution.

The antenna vibrator processing methods mainly include metal die-casting/sheet metal, PCB patch and plastic vibrator. In the 4G era, more metal die-casting/sheet metal processing is used, and the assembly is more manual and inefficient.

In the 5G era, due to the higher frequency band and the Massive MIMO technology, the size of the antenna oscillator becomes smaller and the number is greatly increased. Considering the antenna performance and the AAU installation problem, the plastic antenna vibrator scheme has certain comprehensive advantages.

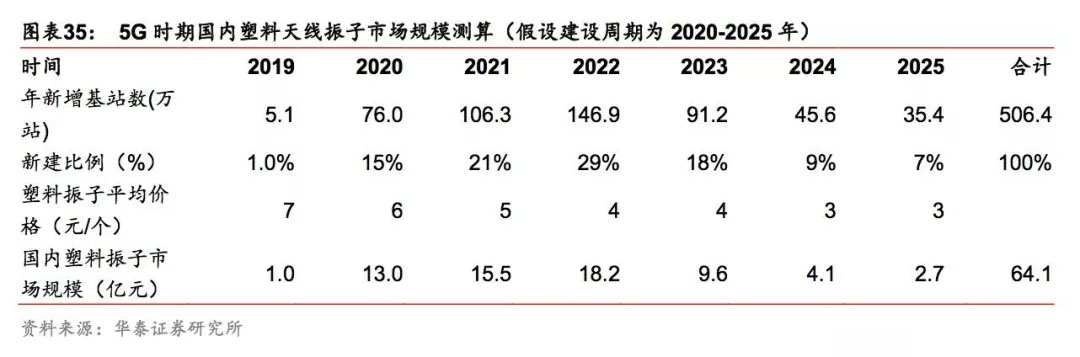

The antenna oscillator market is expected to reach 6.41 billion yuan.

A base station requires a three-sided antenna. It is assumed that the mainstream single-sided antenna scheme adopts 192 oscillators, and correspondingly requires one base station to require 3*192=576 vibrators.

Considering that the current plastic antenna oscillator has not yet been mass-produced, according to the survey, the initial period of a pair of vibrators is about 7 yuan, and the price at the maturity may drop to 3 yuan/pair.

As the main component of the 5G antenna, the antenna oscillator can be concerned with Yinbaoshan New, Shuobeide and Feirongda.

Miniaturization and lightweight push ceramic dielectric filters or become mainstream solutions

The filter is one of the core components of the RF unit.

As more and more network bands are supported by the mobile base station, the filter becomes an inaccessible part of the RF module. The antenna sends all the received frequency band signals to the RF front-end module, but we only want to select the signal of the specific frequency band. For processing, a filter is needed to eliminate the interference clutter, allowing the useful signal to pass through as much as possible without attenuation, and to attenuate the unwanted signal as much as possible.

In the 5G era, the increase in the number of antenna channels and the antennaization of antennas place higher demands on antenna design, and miniaturization and weight reduction are the basis.

In the 4G era, the antenna form is basically 4T4R (FDD) or 8T8R (TDD). According to the current test situation, the 5G era may be dominated by 64T64R large-scale array antennas.

The number of channels increased by 7-15 times compared with the same period of last year, which means that the demand for RF devices increased by 7-15 times compared with the same period of the previous year. At the same time, the passive part of the antenna will be combined with the RRU as AAU, which both put forward the volume and weight of the antenna in the 5G era. High design requirements.

According to Figure 30, in the 4G era, the weight of the passive antenna + RRU is about 24-34 kg. The weight of the 5GAAU currently tested is about 45 kg, and the weight is increased by 32% to 88%.

Therefore, under the trend of 5G antenna integration, miniaturization and light weighting have become the basis of antenna design.

5G or ceramic dielectric filter.

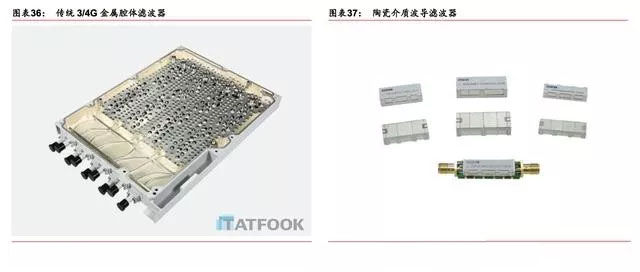

During the 3/4G period, metal filters became the mainstream technology solutions of that era with mature technology and good performance. In the 5G era, equipment manufacturers and antenna manufacturers are also developing miniaturized metal cavity filters to meet 5G requirements.

According to grassroots research, according to the single channel calculation, the weight of the miniaturized metal cavity filter is about 20% heavier than the dielectric filter.

As mentioned above, the future 5G base station will pay more and more attention to the miniaturization and light weight of the device. Under the premise of satisfying the performance, the ceramic dielectric filter becomes the main device with the advantages of light weight, anti-temperature drift performance and miniaturization. One of the main options for business.

Considering that China Mobile's future 5G construction will be based on the 2.6GHz frequency band, the single-channel power requirement of the 2.6GHz16T16R antenna is higher than that of the 3.5GHz frequency band 64T64R antenna. At this time, the small metal cavity filter is more dominant, so the antenna may be selected in the 2.6GHz band. Small metallization cavity filter.

The dielectric wave guide performs better than the dielectric cavity.

Ceramic dielectric filter technology solutions mainly include a dielectric cavity (Mono block) and a dielectric wave guide (Wave guide). Because the dielectric cavity scheme has less power and the performance is worse than that of the dielectric wave guide, the current mainstream technical scheme of the ceramic dielectric filter is the dielectric wave guide.

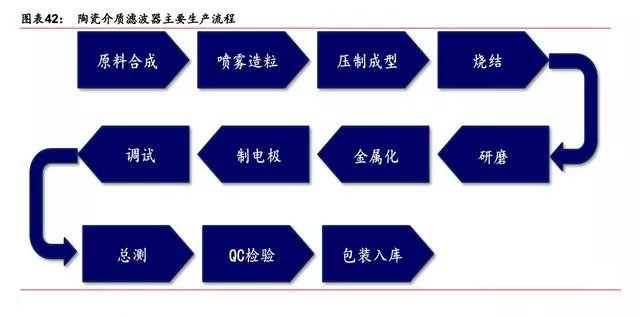

The performance of ceramic dielectric filters is determined by the powder formulation and production process. The performance of ceramic dielectric filters is mainly determined by the following factors:

1) Quality factor Q: The larger the Q, the smaller the filter insertion loss, which means that the better the frequency selection characteristics, the lower the cost; when the insertion loss is 1dB, the signal power is attenuated by 20%, when the insertion loss is 3dB, Then the signal power is attenuated by 50%;

2) Dielectric constant εr: The higher the dielectric constant, the smaller the device is integrated and integrated;

3) Resonant frequency temperature coefficient tf: The operating temperature of the communication device is constantly changing, and the temperature change also causes the resonance frequency to change. The smaller the coefficient, the smaller the resonance frequency change caused by temperature drift;

The upstream materials of the ceramic dielectric filter mainly include titanium oxide (TIO2), zirconium oxide (ZrO2), aluminum oxide (AIO3), barium carbonate (BaCO3), etc., and the amount of raw materials required for the ceramic dielectric filter accounts for a small proportion of the total upstream raw materials. Therefore, these raw materials are easy to purchase.

According to the industry chain research, raw material synthesis, that is, ceramic dielectric powder material formulation is one of the key factors determining the performance of the filter. At the same time, in the production process of the dielectric filter, it is necessary to control the process to produce less impurities, fewer defects, and uniform grains. Distributed ceramics, so the performance of ceramic dielectric filters is determined by the powder formulation and production process.

At present, domestic filter manufacturers mainly produce metal filters in 3/4G, and it is less difficult to upgrade small metal cavity filters in the future.

The ceramic filter industry chain is currently dominated by Huawei. The domestic companies that can produce ceramic dielectric filters mainly have unlisted StrongFirst Electronics. Hong Kong-listed company Dongdian Communications has also indicated that it has the capacity of dielectric wave guide filters.

Ceramic dielectric filters that can be supplied overseas mainly include CTS in the United States and Murata in Japan, of which CTS is the originator of dielectric filters.

According to the above description, in the actual construction of 5G, operators may choose different multi-antenna schemes (64T64R or 16T16R) according to coverage scenarios and capacity requirements.

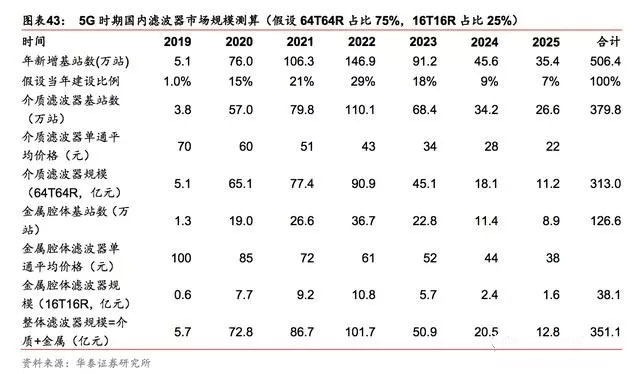

We assume two scenarios to measure the market elasticity of the filter, assuming that the ratio of the construction of the 16T16R and 64T64R is half, and the number of small metal cavity filters and ceramic dielectric filters is half; hypothesis scenario 2: 64T64R construction ratio For 75%, 16T16R is 25%. According to the above, the 16T16R will use a small metal cavity filter, which corresponds to a small metal cavity filter ratio of 25% and a ceramic dielectric filter ratio of 75%.

During the construction of 4G scale, according to the factory price of the filter, it is estimated that the domestic base station filter market scale will be about 2.7 billion yuan per year, assuming that the proportion of 64T64R construction is 75%. It is expected that the peak period of construction (2020-2023) macro base station filter The market space can reach about 50.9-101.7 billion yuan per year. Compared with the 4G scale construction period, the market space has increased by 89%~277%.

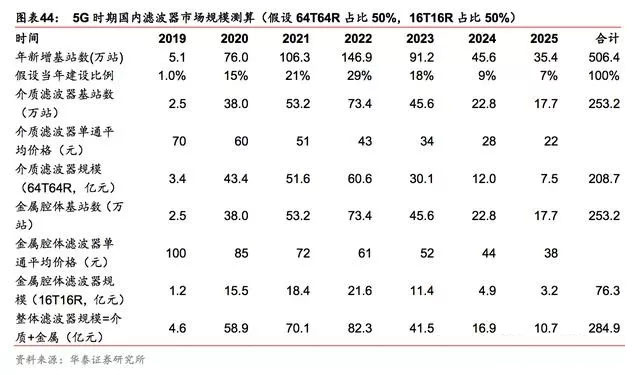

Assume that 64T64R accounts for 50%, and market space increases by 54% to 205%.

Assume that the proportion of 64T64R construction is 50%, and the construction period of 5G is 2020-2025. It is estimated that the market space of macro base station filter in the peak period of construction (2020-2023) can reach about 41.5-82.3 billion yuan per year, compared with 27% per year in the construction period of 4G scale. Billion, the market space increased by 54% to 205%.

The base station filter market space has increased significantly.

High-speed and high-speed PCB board, the value of single-base station PCB is increased by more than 7 times

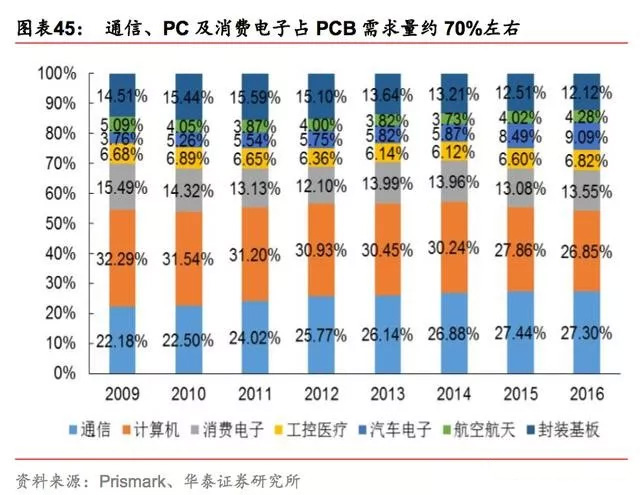

A circuit board is a key interconnect for assembling electronic devices.

Printed circuit board (PCB) refers to a printed board on a universal substrate that forms a point-to-point connection and printed components according to a predetermined design. Its main function is to make various electronic components form a predetermined circuit connection and relay transmission. effect. It not only provides electrical connections for electronic components, but also carries digital and analog signal transmission, power supply and RF microwave signal transmission and reception functions of electronic devices. It has a wide range of downstream applications and is therefore called the “mother of electronic products”. There are many types of PCBs, and the package substrate is excluded. Generally, the PCB is divided into a rigid version (single panel, double panel, multi-layer board), a flexible board, and a rigid-wound board according to physical properties of the material.

From the perspective of product structure, the multi-layer board in the current PCB market still dominates.

PCBs in the communication field are mainly concentrated in wireless, transmission, data communication and other application fields. The products cover back planes, high-speed multilayer boards, and high-frequency microwave boards. Unlike consumer electronics PCB products, which are mostly flexible boards (FPC) and high-density interconnected printed circuit boards (HDI), communication PCBs are mostly rigid multilayer boards.

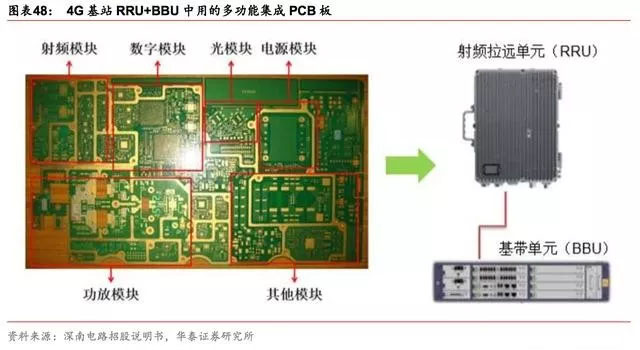

4G base stations only have RRU+BBU PCB requirements. The 4G base station architecture mainly includes a passive antenna, a radio remote unit (RRU), and a base band unit (BBU). The passive antenna is mainly connected by a radio frequency cable, and the PCB inside the RRU mainly includes an RF board. Base band board and backplane.

The new architecture and new technologies of 5G base stations increase PCB demand.

As mentioned above, in the 5G base station architecture, the passive antenna will be combined with the RRU to form a new unit-AAU, and the AAU will contain some physical layer functions; and the BBU will be split into CUs and DUs.

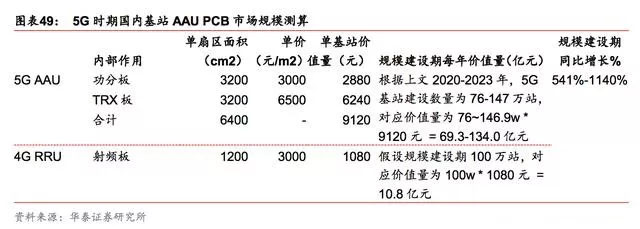

Referring to the design of the current 5G experimental network AAU equipment, it is expected that each AAU will contain two boards: one power board and one TRX board. The power board mainly integrates the power division network and the calibration network. It is usually a two-layer board + a four-layer board, or integrated in a six-layer board. The TRX board mainly integrates power amplifier (PA) + filter + 64 channels. Devices such as letter machines and power management are integrated on the same circuit board, typically 12-16 layers of composite boards.

Since the internal connection of the AAU device is more in the form of PCB, the number of single-site PCBs in the 5G period will be significantly higher than that in the 4G period.

High-frequency and high-speed requirements push up the price of veneers, and the value of 5GAAUPCB has increased by more than 7 times.

Considering that 5G puts higher requirements on the integration of the antenna system. The AAU RF board needs to integrate more components in a smaller size. In this case, to meet the need for isolation, more layers of printed circuit board technology are required.

In addition, the size of the AAU RF circuit board is larger than that of the 4G period. Considering the increase of the transmit power of the 5G base station and the higher operating frequency, the 5G RF circuit board also proposes high-speed performance and high-frequency performance of the material. Higher requirements.

Therefore, from a comprehensive perspective, the number of layers increases, the size increases, and the material requirements increase. The value of the 5GAAU PCB board is significantly higher than that of the 4GRRUPCB.

The domestic antenna RF side PCB market is expected to reach 47.03 billion yuan.

After calculation, the value of the 5G single base station RF side PCB is about 9120 yuan, and the value of the 4G single base station RF side PCB is about 1080 yuan. It can be found that the value of a single base station is increased by more than 7 times

As mentioned above, we estimate that the scale of domestic 5G macro base stations can reach 5.064 million stations. Considering that PCB prices have stabilized and increased slightly in recent years, assuming PCB prices remain unchanged, the scale of RF side PCBs in the 5G period can reach 46.18 billion yuan.

Based on the above, we believe that the 5G base station circuit board market is expected to increase in price.

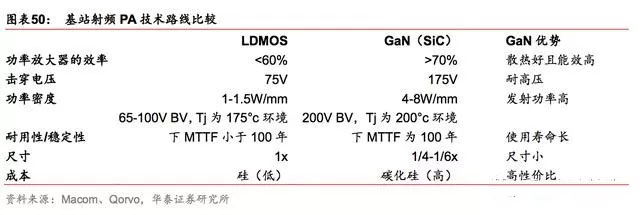

Tradition and innovation go hand in hand, and the acquisition of power amplifier targets by state-owned assets is expected to fill the A-share blank 3/4G period with the horizontal diffusion metal oxide semiconductor (LDMOS) process.

The RF power amplifier is the core component of the wireless transmitter, so that the wireless signal has sufficient transmit power to radiate outward.

At present, power amplifiers for base stations mainly use silicon-based laterally diffused metal oxide semiconductor (LDMOS) technology.

LDMOS has limitations, and gallium nitride (GaN) has become the main technical direction of the medium and high frequency bands. In the future, the 5G commercial frequency band is mainly around 3.5GHz. LDMOS technology has limitations in high frequency applications: the bandwidth of LDMOS power amplifiers will be greatly reduced with the increase of frequency, and LDMOS is only effective in the frequency range not exceeding about 3.5GHz. Therefore, the performance of LDMOS in the 3.5 GHz band has begun to show a significant decline.

In addition, the AAU power of the 5G base station is greatly improved, and the single-sector power is increased from about 50W in the 4G period to about 200W in the 5G period. The traditional LDMOS process will be difficult to meet the performance requirements.

With the advancement of semiconductor materials technology, gallium nitride (GaN) is becoming the main technical route of the medium and high frequency band PA. The advantages of GaN technology include energy efficiency improvement, wider bandwidth, higher power density and smaller volume, making it an LDMOS. Natural successor.

Massive MIMO antennas require device miniaturization with GaN sizes ranging from 1/6 to 1/4 of the LDMOS size.

GaN can increase power by 4 to 6 times per unit area compared to LDMOS.

That is, under the same transmit power specification, the GaN die size is 1/6 to 1/4 of the LDMOS die size.

Due to the size requirements of the power amplifier in the base station and the energy density of the material, the maximum transmit power of the LDMOS near 3.5 GHz will be greatly reduced, resulting in the need for more LDMOS devices. Based on this, GaN has higher power density characteristics and can realize smaller devices. The package is therefore very suitable for 5G Massive-MIMO antenna systems.

Referring to the upstream purchase price of the experimental 5G base station, the current power amplifier for the 5G base station in the 3.5GHz band uses a LDMOSprocess. The price of a single sector is more than $400, and the price of a power amplifier using a GaN process is more than $700. .

The price of a single sector of the current 4G power amplifier is about 200 US dollars, and the price of the 5G power amplifier has reached 2 to 3.5 times of the 4G period.

Although the performance of GaN technology is outstanding, considering the expensive cost of GaN, it is expected that the initial 5G power amplifier may be dominated by LDMOS and GaN. As the cost continues to decrease, the subsequent GaN is completely replaced.

Considering the monopoly of the power amplifier industry, we expect that the price reduction space during the 5G scale construction period is relatively limited.

The power amplifier market space is expected to increase significantly.

In the peak period of 4G construction, the average annual market space of power amplifiers in the domestic market is about 4.2 billion yuan. Considering the substantial increase in the price of single-station power amplifiers, in the 5G era, the sharp increase in the price of single-station will drive the total market space of power amplifiers to increase significantly. It is assumed that the 5G construction period is 2020-2025, and the peak construction period is expected (2020-2023). The macro base station power amplifier market space can reach about 108.2-188.9 billion yuan per year. Compared with the 4G scale construction period, the market space has increased by 158%-350%.

The domestic scarce power device target is looking for A-share listing.

In the field of traditional base station power amplifiers, it is mainly monopolized by NXP, Freescale and Infineon. In 2015, NXP completed the acquisition of Freescale.

In order to avoid antitrust investigation, NXP will have its own RFPower department. It was sold to Beijing Jianguang Capital at a price of US$1.8 billion. The acquired

NXP RFPower division is now reorganized as Ampleon. By the end of 2016, Ampleon's market share in the global base station power amplifier sector reached approximately 38%. The second in the world.

In June 2018, the domestic A-share listed company issued a circular information announcement, and signed a "Cooperation Letter of Intent" with Beijing Jiaguang Asset Management Center, one of the shareholders of Hefei Ruicheng, to purchase its shareholding in Hefei Ruicheng, thereby indirectly acquiring Ampleon Equity.

In the future, with the maturity of high-frequency band technologies such as millimeter waves, GaN as a mainstream technology will become inevitable, and compound semiconductor-related industrial chain companies will benefit in depth.

5GAAU internal RF connection with board-to-board blind fork connector

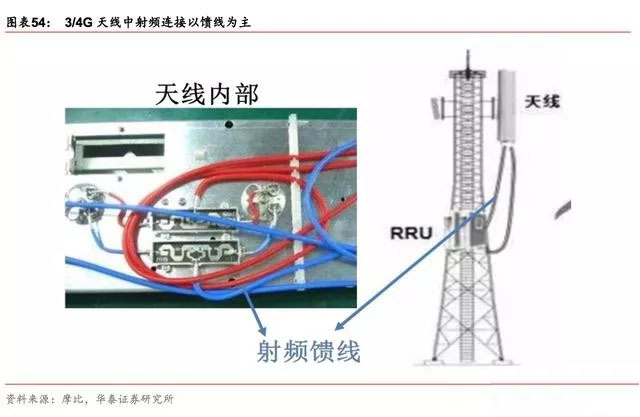

The 3/4G period exists in the form of a feeder network and is connected by a feeder.

During the 3/4G period, the antenna and the RRU are connected to the RF device through the feeder.

The RF feeder between the antenna and the RRU mainly includes a main feeder and a jumper. The jumper provides a connection between the base station antenna and the main feeder, the main feeder and the BTS, which is generally a 1/2" cable; the main feeder is the equipment room to the antenna platform. Interconnection, generally using 7/8" cable.

The internal feeder of the antenna is mainly a semi-flexible cable.

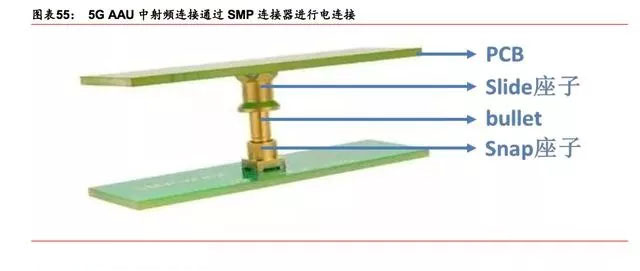

In the 5G era, the number of channels is increased and integrated, and the RF connection is mainly a board-to-board blind fork connector.

The blind plug connector is electrically connected to the input end of the antenna RF channel and the output port of the transceiver component.

The type and form of the blind plug connector are many and can be freely selected.

The SMP board-to-board connector assembly is a floating structure consisting of a snap holder soldered to the PCB, another slide holder soldered to the PCB, and an intermediate adapter bullet.

The two carriers are soldered to two PCB boards, and the three connectors and the two PCB boards form a connector circuit board assembly.

The main manufacturers of domestic connectors: Xi'an Huada, Jin Xinnuo, AVIC Optoelectronics (electric connector products in the aviation market share of 60%), Tongmao Electronics (6908 factory subsidiaries)

Major overseas connector manufacturers: TE Connectivity Tyco Electronics (USA), Amphenol Amphenol (USA), Rosenberger Rosenberg (Germany), RADIALL (France), etc.

The RF connector market can reach 9.44 billion yuan. A base station requires a three-sided antenna. It is assumed that the mainstream single-sided antenna scheme adopts 64T64R in the future, and the number of blind fork connectors required for one base station is 66*3=198.

According to grassroots research, the current domestic manufacturer price of SMP blind plug connector is about 15 yuan/piece, and the future mature period is expected to drop to 6 yuan/piece. Assuming that the 5G construction period is 2020-2025, it is estimated that the market space for macro base station connectors in the peak period of construction (2020-2023) will reach about 14.1-26.8 billion yuan per year.