"Internet celebrity" IoT chip: shipments surge! Players flock in and fight! The

2021-02-27

In 2020, operators will accelerate the withdrawal of 2G and their strong support for NB-IoT and Cat.1, which once excited the entire Internet of Things industry.

Unexpectedly, the new crown epidemic in 2020 disrupted the process of the entire market. Judging from what I learned from the industry, NB-IoT in 2020 has not reached the previous expectations. Since CAT.1 has just started, there has not been a large number of releases. goods.

However, these two cellular IoT markets have gradually recovered in 2021. According to news from multiple channels, this year will be a year for high-speed shipments of NB-IoT and Cat.1. At the same time, chip players are also Do more layouts on products and markets.

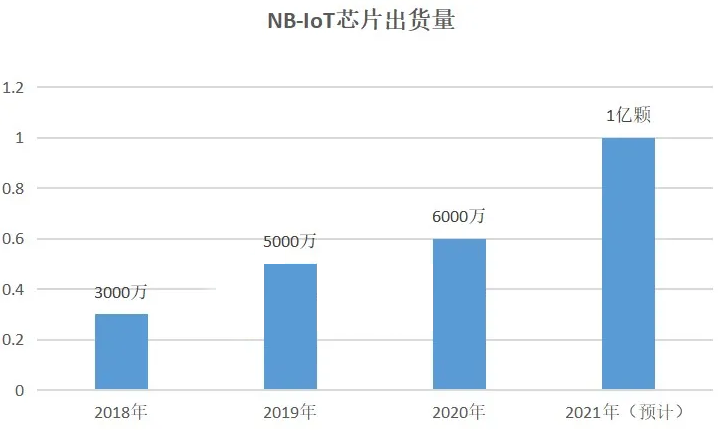

In 2020, NB-IoT chip shipments will reach 60 million, and Cat.1 will ship 10 million

After three or four years of development, NB-IoT chips will enter a stage of rapid development from 2018 to 2019. Originally, the industry estimated that shipments of NB-IoT chips would reach 100 million in 2020, but due to the impact of the epidemic, only 6,000. Ten thousand shipments.

Yang Yueqi, director and vice president of Mobilechip Communications, told a reporter from Electronic Fanyou.com that the entire NB-IoT market was affected by the epidemic in the first half of last year, but starting from the third and fourth quarters, as the epidemic stabilized and demand rebounded, NB-IoT shipments It has begun to climb rapidly, and has maintained strong growth since the beginning of 2021, and its application areas have also been continuously expanded.

Of course, NB-IoT has been widely used in isolation prevention and control terminals such as NB-IoT door sensors. Chen Zhenglei, Marketing Director of Xinyi Technology, said that after several years of technological ecological construction and market education, NB-IoT projects are no longer limited to three-meter and other fields. In addition to anti-epidemic products, they are also engaged in firefighting, electric vehicle monitoring, and shared intelligence. Markets such as home appliances are emerging.

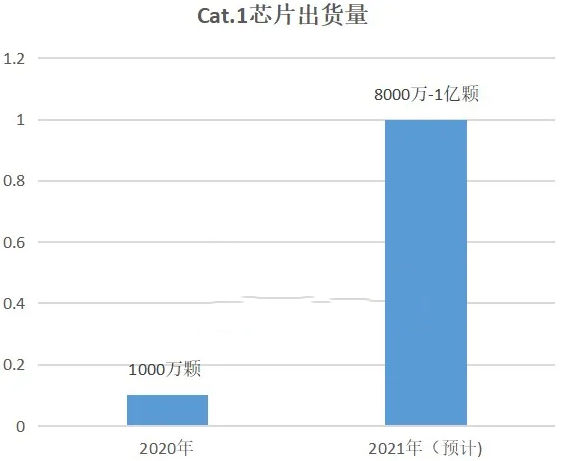

Cat.1, as a medium and low-speed Internet of Things technology, will be vigorously promoted in 2020 from operators, chips to module manufacturers. Although Cat.1 is not a new technology, its promotion time is not long, and the price of modules is relatively high. High and without large-scale application support, the shipment of Cat.1 chips in 2020 will be around 10 million.

NB-IoT and Cat.1 took a breather in 2020, but 2021 is a year of great development. At the beginning of the new year, chip manufacturers have worked hard to win a larger market this year.

NB-IoT chip market situation

In previous reports, we introduced the main players in the NB-IoT market. HiSilicon, Ziguang Zhanrui, MediaTek, etc. are the main players in the head, and a group of start-up chip companies include Yixin, Xinyi, Zhilianan, Nuoling, and Xinyi. Elephant and so on.

At present, HiSilicon has a large share in the NB-IoT market and is an absolute main force, followed by Ziguang Zhanrui and MediaTek; start-up companies such as Yixin, Xinyi, and Zhilianan have gradually emerged in the NB-IoT market. Higher cost performance is gaining more and more recognition.

At the end of 2020, HiSilicon launched the latest Boudica200 chip, and in February this year, many modules equipped with this chip were launched on the market, including Quectel and China Mobile IoT.

Boudica 200 adopts an innovative high-integration architecture. It integrates MODEM, MCU, PA, power management devices, Memory subsystem, etc. on a SOC chip, which greatly reduces the number of peripheral components of the module and greatly reduces the number of modules. Group area, the module area of a typical frequency band configuration can be reduced to 10mm*10mm.

Boudica 200 also implements BLE5.0, GNSS (including GPS and Beidou) and a dedicated security processing unit on the same chip without increasing the chip area to support more applications with combined solution capabilities. In particular, the dedicated security unit not only supports secure startup, loading, execution, and FoTA upgrades, but also supports the iSIM function so that the terminal can be designed without the SIM card slot, which further reduces the design cost and volume of the terminal.

This chip is a new generation product launched by HiSilicon following the two generations of Boudica120 (2016) and Boudica150 (2018) for terminal operation and maintenance, IoT security, and the pursuit of lower power consumption and other NB-IoT market pain points. It will play its advantages in many applications such as equipment operation and maintenance, smart door locks, smart street lights, smart agriculture, and smart logistics.

Also at the end of 2020, Ziguang Zhanrui launched the V8811 NB-IoT chip. This is a 5GNB-IoT industrial controller chip designed based on the latest frozen 3GPPR16 standard, which can coexist with the 5GNR network and access the 5G core network.

As a 5GR16-oriented NB-IoT chip, V8811 not only leads in communication capabilities, but also brings many innovations in features such as safety, reliability, and power saving. V8811 is the industry's first NB-IoT chip that supports TEE+ national secret algorithm; it is also Zhanrui's first industrial-grade 5GNB-IoT chip; in the face of the extreme pursuit of low-power narrowband IoT products in thousands of industries, V8811 The power consumption performance is 50% optimized compared to the previous generation products.

In the NB-IoT chip market of master Rulin, a group of start-up chip companies such as Yixin, Xinyi, and Zhilianan have formulated differentiated product strategies from the beginning.

MobileCore Communication has successfully developed and mass-produced two NB-IoT chips, EC616 and EC616S, which have been highly recognized by the market due to their "low cost, low power consumption, high performance, high reliability, and wide voltage" characteristics.

EC616 was successfully taped out for the first time in April 2018 and officially mass-produced in June 2019. With its ultra-low power consumption, ultra-high integration, ultra-high communication performance, ultra-high hardware adaptability and other characteristics, it has won many domestic Mainstream module vendors, such as Quectel, Lierda, Youfang Technology, Fibocom, SIMCom, Quectel, Meige Intelligence, Jiulian Technology, Yuge Information, Ruiqi Electronics, Broadwing Communication, Beijing Hua With the high trust of Hongkong, Yuncheng Technology, Tuya Smart, etc., all manufacturers have shipped in large quantities, and the monthly shipments have exceeded one million, which is mature and stable.

In 2020, Mobile Core Communications will launch a more integrated NB-IoT chip EC616S, with only 18 peripheral components, module size as low as 10x10mm, receiving sensitivity as low as -142dBm, PSM current as low as 0.8uA, supporting 2.2- The 4.5V ultra-wide voltage and other characteristics are not only suitable for low-power vertical industries such as water meters, gas meters, and smoke detectors, but also suitable for application scenarios that require small sizes such as wearables.

Corewing will achieve mass production of XY1100 in 2019-2020. The product has a single chip integrated CMOS PA, ultra-low power design, PSM power consumption as low as 700nA, supports global full-band commercial use, and the SDR architecture can be easily expanded.

Chen Zhenglei said that Xinyi's product strategy is to follow the application and deepen the industry application. On the basis of general chips, relying on the understanding and grasp of market segments, coupled with the team's research and development capabilities, we can provide customers with differentiated chips. For example, in the meter reading market where Core Wing has been deeply involved, the company can provide communication chips plus MCU components to improve integration and reduce customer research and development.

It is reported that Xinyi will continue the XY1100 series to launch two new NB-IoT products this year, including the high-performance NB-IoT industrial-grade MCU XY1100 A and the cost-effective converged communication SoC XY1100E.

Zhilian An launched the MK8010 last year, and earlier this year it launched the MK8020. The MK8020 is the world's smallest NB-IoT chip.

Zhijun Wang, vice president of sales, said that the new generation of MK8020 chip size is smaller, based on 55nm low-power process, QFN package is only 4.5*4.5mm. The chip supports advanced features such as 32K crystal-free design, high-speed LPUART and fast frequency sweeping, and is designed for multiple typical scenarios of the Internet of Things, which is very suitable for the use of wearable products.

In addition, Zhilianan is the exclusive partner of China Mobile's self-developed NB-IoT chip, and will jointly develop NB-IoT based on 40nm ultra-low power consumption. In 2020, the company's NB-IoT shipments exceeded 1 million.

At present, water meters and gas meters have reached 20 million shipments, and tens of millions and asset tracking have reached tens of millions of shipments respectively. There will also be white electricity, smart street lights, parking, agriculture, door locks, tracking, and electricity meters. It is a million-level shipping market.

In the future, more applications will not only use the communication function of NB-IoT, but also put forward higher requirements on volume, power consumption, cost, and functions. This gives these NB-IoT chip manufacturers opportunities for product upgrades and market expansion. .

In 2021, Cat.1 is expected to increase by 10 times, with more power and more players

The Cat.1 market, which has been in the incubation period since last year, has shipped only tens of millions of dollars. However, this Internet of Things upstart has high hopes, especially under the trend of 2G withdrawal from the network and the migration of Cat.4 to Cat.1, the industry generally expects It is estimated that the shipment of Cat.1 in 2021 will reach the level of 8000 to 100 million, which is almost 10 times the expected growth.

Yang Yueqi analyzed that the withdrawal of 2G and 3G networks is the general trend, providing good opportunities for Cat.1. Coupled with the natural growth of the Internet of Things, the entire industry and the market have higher expectations for Cat.1. With the migration of 2G products to NB-IoT and Cat.1, coupled with the gradual decline in the cost of Cat.1 modules, the scale of the Cat.1 product market is bound to be further enlarged, and the future of Cat.1 can be expected.

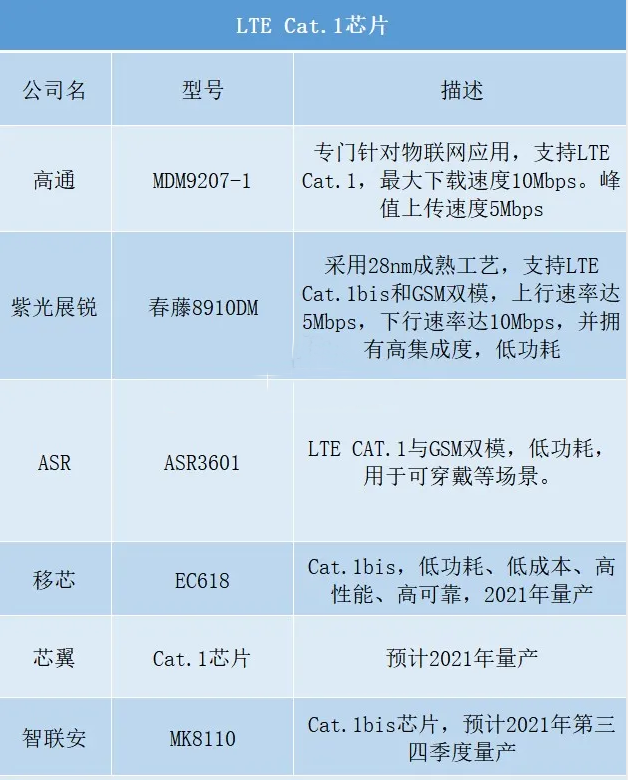

In order to seize the upcoming Cat.1 market opportunity, manufacturers such as Yixin, Xinyi, and Zhilianan will use Cat.1 chips this year, which means a significant increase in Cat.1 chip players. In the past year, Ziguang Zhanrui and Aojie Technology have taken the lead in becoming the main force in the market with their respective Cat.1 chips. With more and more players joining, this year's Cat.1 is destined to be unprecedentedly lively.

How to ensure the stability of the supply chain

In October last year, a huge fire broke out in a factory of Asahi Kasei Microelectronics Co., Ltd. (abbreviation: AKM) Noboka Manufacturing. This fire is panic because AKM accounts for more than 90% of the temperature compensated crystal oscillator (TCXO) IC market. The fire at the AKM factory directly caused price increases and shortages in the temperature-compensated crystal oscillator IC market. Industry insiders estimate that it will take about half a year for the AKM factory to recover.

In the case of a shortage of TCXO, various manufacturers modified their designs in time to avoid shortages. Yang Yueqi said that the price of TCXO crystal oscillators first exploded. At that time, there were still stocks in the original factory and channels. After that, the inventory was exhausted and the money could not be bought. The price increase was just a prelude to the shortage of TCXO.

At the beginning of the design, EC616 and EC616S chips of MobileCore Communications adopted the DCXO solution to reduce the cost of the module, and replaced it with crystal passive crystals. The current spot price of TCXO, which was about 1.3 yuan, has risen to 8 or 9 yuan. Not necessarily in stock. Crystal is relatively low in market price, and the supply is relatively sufficient. It can be used as an alternative to TCXO.

Chen Zhenglei said that TCXO can be replaced by using an RC oscillator and a temperature compensation algorithm.

In addition, Zhilian's MK8020 also adopts a new design scheme to avoid the problem of TCXO shortage.

Yang Yueqi said that the shortage of crystal oscillators is only part of the problem of the supply chain of IoT modules. In fact, peripheral components such as 32k, RF, and PCB are all out of stock. Shift Core’s NB-IoT chip is highly integrated, integrating PA, radio frequency switches, filters, matching circuits, etc., so that only 18 peripheral components of the chip are needed, which can also greatly reduce the supply of peripheral components for customers. Cargo risk.

In addition, Shift and the foundry have reached an agreement to ensure that Shift chips are not out of stock, helping customers to expand their markets with confidence.

Chen Zhenglei mentioned that it is necessary to grasp the cooperation with foundry and packaging and testing. SMIC has always maintained a good cooperative relationship with SMIC. At the beginning of SMIC's establishment, SMIC specially presented a plaque to congratulate it by writing "Use the core as the wing to promote the Internet of Things".

Xinyi is also investing money in the packaging and testing process to obtain more production capacity guarantee. Establishing a good supply chain is very important in this period of semiconductor shortages and price increases.

Zhilian's chip foundry is in UMC. Wang Zhijun said that Zhilian's and UMC have always cooperated well and will strive to obtain more capacity guarantees when semiconductor production capacity is tight. Zhilian's revenue will reach 80 million yuan in 2020 and is expected to exceed 100 million yuan in 2021.

summary

NB-IoT and Cat.1, as low-to-medium-speed and wide-area IoT technologies, will grow considerably in recent years. First of all, NB-IoT has entered an explosive period. Several tens of millions of applications and many millions of applications to be developed are superimposed, and shipments are growing exponentially every year. Secondly, the huge 2G stock market and the migration of 3G and 4G are billions of dollars for Cat.1. This is also the reason why giants have to get ahead of schedule and start-ups keep influx. NB-IoT and Cat.1, as one of the foundations of the Internet of Things connection, have promising development prospects.